ZigZag and Keltner Channel Binary Options Strategy – How I Made $18,633 in One Session

The ZigZag and Keltner Channel binary options strategy is one of the clearest visual methods for spotting reversals and trend continuations in short-term trading. It’s especially effective on small timeframes like 30-second or 1-minute charts, where binary options traders need quick but reliable signals.

In this article, I’ll walk you through how this strategy works, how to set it up correctly, and I’ll also share several real trade examples. We’ll even cover an advanced twist: how to use RSI divergence alongside ZigZag and Keltner for stronger confirmations.

👉 If you are just starting and need a broker, read our guide on PocketOption or sign up directly. Always begin on a free demo account before risking real money.

⚠️ Risk Disclaimer: Binary options are high-risk instruments and may not be suitable for all investors. This guide is for educational purposes only. For further info read our Risk Disclaimer.

Why Use the ZigZag and Keltner Channel Binary Options Strategy?

The ZigZag and Keltner Channel binary options strategy stands out because it combines three critical elements:

- ZigZag → simplifies chart structure and highlights meaningful highs and lows.

- Keltner Channel → defines dynamic support and resistance levels.

- RSI (Relative Strength Index) → measures short-term momentum.

The ZigZag indicator works by filtering out smaller price movements to highlight the major swings in the market. It connects significant highs and lows with straight lines, making it easier to identify overall trends, reversals, and chart patterns while ignoring market noise.

The Keltner Channel is a volatility-based indicator that forms dynamic bands around price using an exponential moving average and the Average True Range (ATR). It helps traders identify breakouts, reversals, and overextended moves. For a deeper dive, check my full guide on the Keltner Channel RSI binary options strategy, where I show how it can be paired with momentum oscillators for even more accuracy.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and magnitude of price changes on a scale from 0 to 100. Values above 70 typically signal overbought conditions, while values below 30 indicate oversold levels. In this strategy, RSI helps confirm whether a ZigZag or Keltner-based setup has real momentum behind it.

This trio helps traders:

- Spot when trends are exhausted.

- Catch early reversals with strong momentum.

- Filter false signals in sideways markets.

Compared to other systems like the Fractal + Moving Average strategy or the Vortex + Supertrend strategy, ZigZag offers extra clarity by “cleaning” the chart and showing only significant swings.

Step-by-Step Setup

Here’s how to configure your chart for the ZigZag and Keltner Channel binary options strategy:

- Timeframe: 1-minute candles.

- Trade duration: 30 seconds (clock mode).

- Indicators:

- ZigZag → Deviation: 4, Depth: 10, Backstep: 4.

- Keltner Channel → EMA period: 10, ATR period: 5, Multiplier: 1.

- RSI → Period: 5.

👉 If you are new and having trouble with configuration, check the YouTube video here where every step is recorded in detail.

💡 Why these settings?

- ZigZag with deviation 4 ensures only meaningful swings are plotted.

- Keltner Channel (EMA 10, ATR 5) adapts well to fast-moving binary charts.

- RSI 5 is ultra-sensitive, which is crucial for 30s/1m strategies.

Entry Rules

The ZigZag and Keltner Channel Binary Options Strategy works with two main setups:

✅ Bullish Setup (Call option):

- ZigZag prints a downtrend leg, then price bounces back into the Keltner channel.

- RSI rises steeply from a dip (preferably from below 30 toward 50+).

- Candle forms a bullish confirmation (engulfing or strong close inside Keltner).

- Wait for the candle close before entering.

✅ Bearish Setup (Put option):

- ZigZag prints an uptrend leg, then price breaks the Keltner channel lower band.

- RSI drops sharply (preferably from above 70 toward 50 or lower).

- Candle forms a bearish engulfing or strong close outside Keltner.

- Enter only after the candle closes.

👉 Always remember: missing an entry is never as bad as catching a false one. This is how you avoid FOMO (Fear of Missing Out).

For filtering false signals, you can also study the Williams %R and Stochastic strategy.

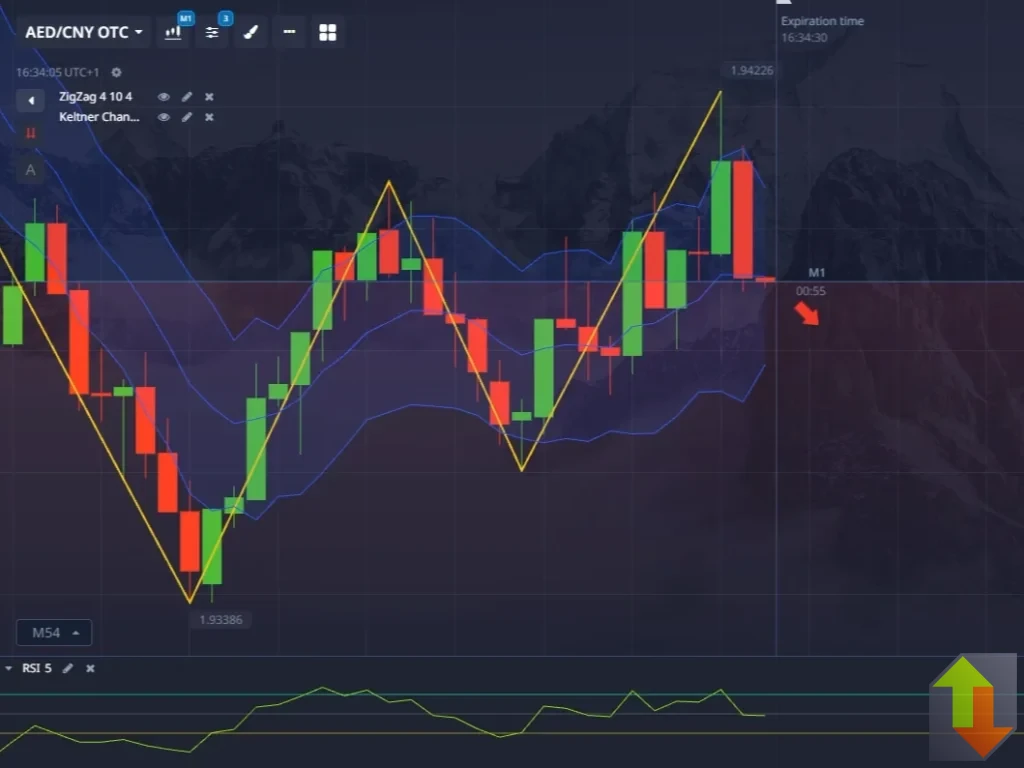

Example Trade 1 – Bearish Setup

The chart printed a strong ZigZag downtrend, and a bearish engulfing candle broke the Keltner lower band.

At the same time:

- RSI fell toward 30, confirming bearish momentum.

- Price had room to continue downward before hitting the next support level.

I entered a 1-minute put (SELL) option, and the trade closed in profit.

⚠️ Important: Always wait for the candle close. ZigZag and RSI signals can “print differently” before the candle finishes.

Example Trade 2 – Bullish Setup

Later, the ZigZag printed a new swing low. The candle reentered the Keltner channel and closed as a bullish engulfing candle.

Key confirmations:

- RSI rebounded steeply from below 30.

- Price clearly broke the bearish trendline, showing trend reversal.

- ZigZag confirmed the swing low.

I entered a call (BUY) option after the candle close.

📷 [Image placeholder: bullish setup screenshot]

Alt text: Bullish setup with ZigZag low, bullish engulfing candle, RSI recovery, and bearish trendline break.

Advanced Tip: Using RSI Divergence

A powerful enhancement to the ZigZag and Keltner Channel binary options strategy is RSI divergence. RSI divergence with this strategy is a powerful confirmation tool. Divergence happens when price makes a new low (or high), but the RSI does not follow — for example, price prints a lower low while RSI forms a higher low. This suggests momentum is weakening and a reversal is likely. When combined with ZigZag turning points and price touching or breaking outside the Keltner Channel, RSI divergence can help filter out false signals and improve the accuracy of trade entries.

- Regular Bullish Divergence → Price makes lower lows (ZigZag shows it), but RSI makes higher lows → potential reversal.

- Regular Bearish Divergence → Price makes higher highs, RSI makes lower highs → bearish reversal.

- Hidden Divergences also work (bullish in uptrends, bearish in downtrends).

This advanced filter can help skip false signals and focus only on high-quality setups. An example trade is shown below with a Hidden Bullish RSI Divergence visualized by the white lines.

The RSI divergence is not dedicated to this strategy, it is a powerful extra confirmation for various trend reversal strategies.

Tips for Using the ZigZag and Keltner Channel Binary Options Strategy

- Always wait for candle close. Intra-candle signals can flip before the bar ends.

- Skip flat or choppy markets. ZigZag prints unreliable signals in sideways action.

- Avoid mixing strategies. Stick with ZigZag + Keltner + RSI in one session.

- Patience beats speed. Better to miss a trade than take a false signal.

- Keep sessions short. Fatigue leads to mistakes.

- Risk control. Trade small, never risk the whole balance like in showcase videos.

For alternative methods, check my Aroon + RSI strategy for trend confirmation, or the Heiken Ashi + SuperTrend strategy for smoother signals.

Practicing Before Going Live

PocketOption offers a free demo mode where you can test the ZigZag and Keltner Channel binary options strategy risk-free.

Beginners should practice with $1 or $10 challenges, often funded easily via crypto top-ups. These small experiments let you trade without stress while still learning fast-paced analysis.

Embedded Video 🎥

I know some traders prefer a visual explanation with audio narration. If that’s you, watch the full video tutorial of the ZigZag and Keltner Binary Options Strategy here:

Risks ⚠️

Trading binary options involves high risk and may not be suitable for everyone. This article and video are for educational purposes only and do not constitute financial advice.

In my video demonstrations, I sometimes risk the full balance for clarity — this is not recommended in real accounts. Professional traders usually risk 1–2% per trade.

Frequently Asked Questions

Conclusion

The ZigZag and Keltner Channel binary options strategy is one of the clearest and most visual methods for short-term trading. By combining ZigZag swings, Keltner bands, and RSI confirmation, it delivers frequent and reliable signals for both beginners and advanced traders.

Just remember:

- Always wait for candle close.

- Skip false signals and sideways markets.

- Manage your risk carefully.

👉 Want to see it in action? Sign up at PocketOption and practice it in demo mode first.

For further learning, also check my guides on:

- Fractal + Moving Average crossover strategy

- Keltner Channel + RSI strategy

- Parabolic SAR + Moving Average strategy

And don’t forget to subscribe to my YouTube channel for more strategies and live trade examples.