Proven Keltner Channel RSI Binary Options Strategy – How I Made $16,192 in 30 Minutes

The Keltner Channel RSI binary options strategy is one of the most effective short-term trading methods I’ve tested. In just a single live session, this approach helped me earn $16,192 in under half an hour.

If you’ve been struggling to find a clear, rule-based method for binary options, this strategy may be exactly what you need. In this guide, I’ll explain the setup step by step, show live trade examples, and share the money management rules that make the difference between success and failure.

If you are new to trading, check our Get Started guide.

Want more strategies like this? Visit my BinaryTrader YouTube channel where I shared numerous tested methods.

⚠️ Disclaimer: Binary options trading is high risk and not suitable for everyone. This article is for educational purposes only and not financial advice. Make sure to read our full Risk Disclaimer.

What Is the Keltner Channel RSI Binary Options Strategy?

The Keltner Channel RSI binary options strategy is built on two well-known indicators:

- Keltner Channel – A volatility channel that expands and contracts with the market. It’s created using an exponential moving average (EMA) and the Average True Range (ATR). Unlike Bollinger Bands, which use standard deviation, Keltner Channels are smoother and often more reliable for breakout detection.

- RSI (Relative Strength Index) – A momentum oscillator ranging from 0 to 100. Traditionally, values above 70 signal overbought conditions, and below 30 indicate oversold. In this strategy, RSI confirms whether a breakout has genuine strength.

Together, these tools filter out weak signals and increase accuracy. The Keltner Channel highlights potential breakout points, while RSI confirms momentum.

Why Use RSI 7 Instead of RSI 14?

Most platforms default RSI to 14 periods, which works for higher timeframes. But in binary options, especially on 30-second charts with 1-minute expiries, RSI 14 is too slow.

By reducing the period to 7, RSI becomes more sensitive and reacts quicker to momentum changes. This allows traders to catch breakout signals right as they happen — critical for short-term setups.

The trade-off is slightly more noise, but when paired with the Keltner Channel, RSI 7 provides the perfect balance.

For a similar volatility-based method, check the Heiken Ashi and SuperTrend strategy, which identifies strong directional moves.

ATR in the Keltner Channel – Why It Matters

The ATR (Average True Range) measures volatility and defines the width of the channel. With an ATR period of 13 and multiplier of 1, the channel adapts smoothly to price action.

- Too high a multiplier → channel too wide → fewer trades.

- Too low a multiplier → channel too narrow → many false signals.

The chosen settings (EMA 11, ATR 13, multiplier 1) make this method highly effective for fast-paced binary options trading.

How to Set Up the Strategy

To trade with the Keltner Channel RSI Binary Options Strategy, configure your platform as follows:

- Chart timeframe: 30 seconds

- Trade duration: 1 minute

- Expiration mode: Clock

Indicator Settings

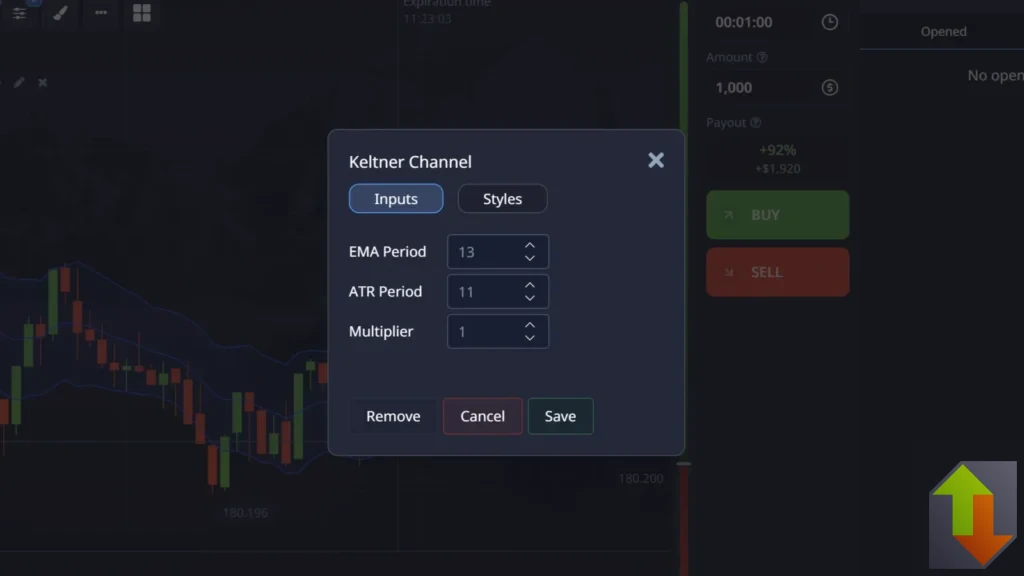

- Keltner Channel

- Moving Average Period: 11

- ATR Period: 13

- Multiplier: 1

- RSI

- Period: 7

👉 If you need some guidance to set up your chart, check the detailed steps in the YouTube video.

👉 Tip: Always choose assets with the highest payout percentages. Refresh your watchlist daily to maximize profitability.

Practicing the Strategy

Always start in demo mode. PocketOption offers unlimited practice accounts.

Before you risk real money, it’s best to practice this method in demo mode.

👉 Try PocketOption Free DemoOnce you’re confident, switch to live trading and use promo code 50START for a 50% deposit bonus. Check more info on Promo Codes.

Entry Rules

The rules of the Keltner Channel RSI binary options strategy are simple but precise:

✅ Buy Trade (Call Option)

- A bullish candle closes above the upper Keltner Channel band after staying inside the channel.

- RSI is above 50, ideally closer to 70.

- No major resistance directly ahead.

✅ Sell Trade (Put Option)

- A bearish candle closes below the lower Keltner Channel band.

- RSI is below 50, ideally closer to 30.

- No major support directly below.

Only take trades when both conditions align.

Example Trades

Here are three examples from my live trading session:

- First Trade

- Price broke through support while RSI confirmed bearish momentum → Result: Win (see it in action).

- Second Trade

- Retest confirmed breakout, candle closed strongly outside channel → Result: Win (see it in action).

- Third Trade

- Resistance rejection combined with bearish RSI → Result: Win (see it in action).

If you prefer reading, I will explain the first trade in detail with screenshots here below:

In the screenshot above, you can see the given example setup for a short trade. A strong bearish candle has closed below the Keltner Channel’s lower band, while the RSI sits under 50 and approaches the 30 level. These are the core criteria of the strategy. In addition, the candle also broke through a minor support zone, adding extra confirmation for the trade. Below is the final outcome of this winning setup:

Watch the full session here if you prefer video with audio narration:

Why Market Context Is Critical

Indicators alone can’t guarantee success. Even with this strategy, you need to evaluate market context.

- If a breakout occurs but price is at a key support/resistance level, the signal may fail.

- If the breakout also breaks through that level, the trade is far stronger.

- Always consider trend direction. A bullish breakout in a downtrend has lower odds.

This is why the Keltner Channel RSI binary options strategy works best when paired with price action analysis.

In the screenshot above, in all three occurences, trigger candles closed below lower band of the Keltner Channel, while RSI was below 50, close to level 30 (which is ideal), but as we dive deeper, it is clearly visible that in the first example price was rejecting from the previous minor support zone, and the signal of the strategy ended up as a false one, while in the other two cases it successfully broke the previous zones, and the trades won (the result of the third one is visible on the previous screenshot.

Pros and Cons

| Pros | Cons |

|---|---|

| Simple to understand | Requires very fast execution |

| Works across multiple assets | False signals in sideways markets |

| Combines trend + momentum | Not suited for long-term investors |

| High payout potential | Needs context with price action |

Money Management and Trading Psychology

A strategy is only as good as your money management. Many traders lose not because their method is bad, but because their risk management is poor.

Practical Tips:

- Risk only 1–2% per trade of your balance.

- Avoid revenge trading after a loss.

- Don’t increase stake sizes impulsively.

- Set a daily limit for wins and losses.

Example:

On a $500 account, risking 2% means $10 per trade. With 65% win rate, you could average steady growth without blowing the account.

⚠️ Important note: In the video demonstrations I risk the full account balance on each trade. This is purely for showcase purposes and to make the strategy easier to follow on screen. In real trading, I apply strict risk management rules and never recommend risking more than a small percentage of your capital per position. Remember — I’m a professional trader with 10+ years of experience, and the video is designed to highlight the strategy, not to suggest overexposing your account.

Discipline is the hardest part. Overtrading, chasing losses, and emotional decision-making destroy accounts faster than bad strategies.

Comparing With Other Strategies

Keltner Channel vs Bollinger Bands

- Bollinger uses standard deviation → reacts quickly but produces more false signals.

- Keltner uses ATR → smoother, better for short-term trading.

RSI vs Stochastic Oscillator

- RSI measures momentum strength.

- Stochastic compares close price vs range.

- RSI is better suited for this binary options breakout strategy.

Binary Options vs Forex Use

The rules also apply in Forex or crypto trading, but signals are rarer on longer timeframes. For beginners, stick with binary options demo mode until consistent.

Extended FAQs

Why I Recommend PocketOption

PocketOption is my go-to platform because:

- Fast execution speed (vital for 30-second charts)

- High-payout assets

- Demo + live in one account

- Deposit bonuses like 50START

Learn more about the platform by reading our full guide of PocketOption.

Conclusion

The Keltner Channel RSI binary options strategy is a proven, rule-based method that works best when combined with market context and proper money management.

To succeed:

- Always practice in demo first

- Apply strict risk control

- Track 100+ trades before scaling up

- Stay disciplined — no strategy can replace patience and consistency

If you want to see this strategy live, watch the video above and explore my other guides. Remember: trading is not about luck but preparation and persistence.

You might also enjoy the $10 challenge with the Fractal and Moving Average Crossover strategy, where I grew $10 into thousands.

If you want to try it yourself, start risk-free:

➡️ Sign up with PocketOption and test the strategy on demo first.

When you’re comfortable, you can transition to live trading and take advantage of PocketOption’s 50% deposit bonus using the promo code 50START.

👉 Don’t forget to subscribe to my YouTube channel for more tested binary options strategies with real trade examples.