Proven Aroon and RSI Binary Options Strategy – How I Made $11,000 in One Session

Trading binary options requires clear rules, discipline, and strategies that are easy to follow in fast-moving markets. One of my favorite methods recently is the Aroon and RSI binary options strategy, which I used to earn over $11,000 in a single live trading session.

In this article, I’ll break down the full setup, explain exactly how the Aroon indicator, Relative Strength Index (RSI), and moving average work together, and share real trade examples so you can see the strategy in action.

👉 Looking for a safe place to practice? You can start with a free demo account on PocketOption — no risk required. Or read our detailed guide of the platform.

⚠️ Risk Disclaimer: Trading binary options is high-risk and not suitable for all investors. The trades shown here are for educational purposes only. Past performance (including my $11,000 run) does not guarantee future results. Make sure to read our full Risk Disclaimer.

📺 Watch the Full Trading Session

🎥 Some traders prefer a visual walkthrough with live trades and audio commentary. If you are one of them, watch my full $11,000 session below:

What Is the Aroon and RSI Binary Options Strategy?

The Aroon and RSI binary options strategy is a short-term method that combines trend confirmation with momentum analysis.

It uses three indicators together:

- Aroon Indicator: Measures the strength of upward or downward moves by showing how recently highs or lows were formed.

- Relative Strength Index (RSI): A momentum oscillator ranging from 0–100. RSI above 50 suggests bullish momentum; below 50 suggests bearish momentum.

- Moving Average (period 19): Smooths price action and acts as a trend filter.

👉 The combination of Aroon + RSI + Moving Average helps filter out weak setups, ensuring you only take trades when trend, momentum, and candle structure all align.

While the Aroon and RSI binary options strategy already provides strong momentum signals, adding a moving average filter makes the system more reliable. The moving average smooths out price data and highlights the overall direction of the market. This helps you avoid taking trades that technically fit the rules but go against the broader trend.

By requiring price to close on the correct side of the moving average, the Aroon and RSI binary options strategy filters out many false breakouts. The moving average acts like a traffic light:

- Above the line → prefer bullish setups.

- Below the line → prefer bearish setups.

This simple confirmation rule increases accuracy, particularly on short 30-second charts where false signals are common. It also gives traders a visual “safety net” that is easy to read in real time.

For a similar approach with volatility filters, check out my article on the Keltner Channel and RSI strategy.

Entry Rules of the Strategy

The Aroon and RSI binary options strategy follows clear, visual rules:

✅ Buy Trade (Call Option)

- Blue Aroon line crosses above red Aroon line.

- Candle closes above the Moving Average.

- RSI is above 50, ideally near 70.

✅ Sell Trade (Put Option)

- Red Aroon line crosses above blue Aroon line.

- Candle closes below the Moving Average.

- RSI is below 50, ideally near 30.

⚠️ Important: Only enter once the candle closes — not before. Trigger candles can change shape, and false signals often occur mid-candle.

⚡ Speed of Execution with Aroon

One thing traders must understand when using the Aroon and RSI binary options strategy is that Aroon crosses often happen sharply. Unlike slower oscillators, the blue and red Aroon lines can top and cross very quickly, meaning you need to react fast once a candle closes and confirms the signal.

Missing the exact entry can sometimes mean missing the move entirely. That’s why practicing on a demo account is so important — it helps you train your reaction speed and execution timing before risking real money. But remember, missing an entry is never as bad as catching a false one. This is one of the most common mistakes beginners make, often driven by FOMO (fear of missing out).

FOMO pushes traders to jump into setups before the candle closes, or to chase signals that don’t fully align with the rules of the Aroon and RSI binary options strategy. Entering too early can turn what looked like a winning signal into a quick loss. It’s always better to let one opportunity go and wait for the next confirmed setup, rather than risk money on an uncertain signal. In binary options, opportunities appear constantly — patience is your edge.

Setting Up the Trading Environment

Here’s how to prepare your chart:

- Chart timeframe: 30 seconds

- Trade duration: 1 minute

- Expiration mode: Clock

- Indicators:

- Moving Average (period 19)

- Aroon (period 16)

- RSI (period 9)

If anything is unclear, have a look at the YouTube video for detailed steps.

👉 Pro tip: Always choose instruments with high payout percentages. Refresh your watchlist frequently to avoid wasting time on low-payout assets.

Example Trades With Live Analysis

Example 1: Bullish Trade Setup

In this example price pushed above the moving average, and the blue Aroon line topped steeply above the red line, confirming a shift in momentum. The RSI also climbed above 50 and was heading toward 70, adding confidence to the setup. Most importantly, the chart showed a clear break of the bearish trendline, signaling that a potential reversal was underway rather than just a small pullback.

As with all setups in the Aroon and RSI binary options strategy, I waited for the candle to fully close before entering. This is critical, because the Aroon lines can adjust sharply mid-candle and mislead traders if they act too early. Once the close confirmed the cross, I entered a 1-minute call (BUY) option.

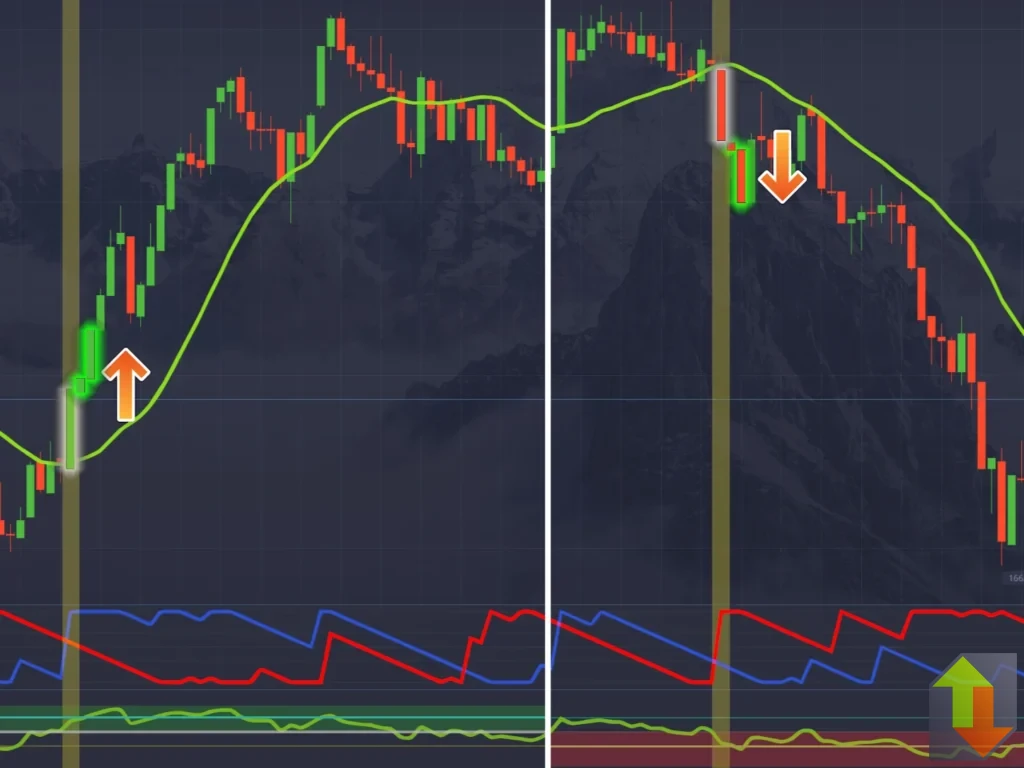

The image below on the left shows the setup where the bearish trendline was broken, with price closing above the moving average, RSI rising above 50, and the Aroon blue line steeply crossing on top. The playout image then captures the next candles moving decisively higher, validating the reversal and ending in a clear winning trade.

👉 Watch this bullish trade in the video at 1:49.

Example 2: Bearish Trade Setup

Later, price dipped below the moving average, and RSI dropped toward the 30 level. At the same time, the red Aroon line topped steeply above the blue line, signaling bearish momentum. I carefully checked the chart and saw that price still had room to fall before reaching the previous support level (marked with yellow box on the image below), which made the signal much stronger. This space gave the trade breathing room to develop rather than being rejected immediately.

As always with the Aroon and RSI binary options strategy, I waited for the candle to fully close before entering, because the Aroon can redraw if the candle shape changes mid-formation. Once the close confirmed the cross and bearish strength, I entered a 1-minute put (SELL) option.

👉 Watch this bearish trade in the video at 3:20.

Why False Signals Happen

Like any system, the Aroon and RSI binary options strategy is not perfect. Some setups fail — and understanding why helps you filter them out.

- Near resistance levels: If a bullish trigger forms right below a major resistance, the move has often “already happened.”

- Weak Aroon crosses: If the red or blue Aroon line crosses in two steps instead of a sharp, steep move, ignore the signal.

- Flat RSI: If RSI hovers around 50 with no clear push toward 30 or 70, momentum is weak.

This example below shows why not every cross of the Aroon indicator should be trusted. Notice how the red Aroon line climbed in a zigzag pattern instead of making a steep, confident move. Even though the cross technically occurred, the lack of strong momentum made the signal unreliable. Filtering out these weak crosses helps avoid unnecessary losses and ensures that only the most powerful bearish setups are traded.

👉 This is why I often say: indicators confirm — but market context decides.

For another case study on filtering signals, read my article on the Fractal and Moving Average crossover strategy.

Comparing With Other Strategies

How does the Aroon and RSI binary options strategy compare?

- Vs. Keltner RSI → Keltner adds volatility channels, while Aroon measures time since highs/lows. Aroon gives earlier signals, but Keltner filters better.

- Vs. Fractal + MA → Fractals mark exact reversal points, but signals are less frequent. Aroon + RSI generates more opportunities, making it better for $10 challenges.

- Vs. Vortex + SuperTrend → Both measure trend strength. Vortex reacts faster, but Aroon offers smoother confirmation with RSI.

👉 For full details, check my guide on the Vortex and SuperTrend strategy.

Practicing Safely With Demo Accounts

Even though this strategy helped me earn $11,000 in one session, I must stress that I risked more than usual for showcase purposes.

For beginners:

- Always start with a demo account. PocketOption provides unlimited practice balance.

- Once confident, switch to small live trades (like $1–$5).

- Only increase size after proving consistency over 100+ trades.

👉 Open a free demo account on PocketOption.

Money Management & Risk Reminder

Trading is never about one lucky day. It’s about risk control and discipline. It’s neither different when using the Aroon and RSI binary options strategy or any other one.

- Risk only 1–2% of your account per trade.

- Avoid revenge trading after a loss.

- Limit your daily sessions — fatigue causes mistakes.

⚠️ Risk Disclaimer: Trading binary options is high-risk and not suitable for all investors. The trades shown here are for educational purposes only. Past performance (including my $11,000 run) does not guarantee future results.

Frequently Asked Questions

Final Thoughts

The Aroon and RSI binary options strategy is one of the most practical systems for traders who want clear, repeatable rules and the chance to capture quick moves in fast markets.

It’s not perfect — no strategy is — but when combined with market context and patience, it can deliver consistent results.

If you enjoyed this guide, I recommend also checking out:

👉 Ready to try it yourself? Start with a free demo account on PocketOption.

Don’t forget to subscribe to my YouTube channel for more strategies, live trades, and future challenge videos.